Engineering Pro Guides is your guide to passing the Mechanical & Electrical PE and FE Exams

Engineering Pro Guides provides mechanical and electrical PE and FE exam technical study guides, practice exams and much more. Contact Justin for more information.

Email: contact@engproguides.com

EXAM TOOLS

Basic Engineering Practice (4 of 80 Problems)

Introduction

Basic Engineering Practice accounts for approximately 4 questions on the HVAC & Refrigeration Mechanical PE exam.

The HVAC & Refrigeration Mechanical PE exam is designed to ensure that a passing engineer is minimally competent to practice engineering. Being minimally competent does include understanding engineering terms, symbols and technical drawings, unit conversions, electrical concepts and economic analysis. However, many of these tasks can be completed without an engineering background and thus the PE exam should provide questions that are more complex than just questions in one of these topics. The questions may include an economic analysis but also with thermodynamics. You may also have to decipher a technical drawing and use the information to complete a heat transfer question or you will complete a power cycle question and need to convert units to match the selected answers.

The topics under NCEES are 1. Units and conversions, 2. Economic analysis, 3. Electrical concepts (e.g. power consumption, motor ratings, heat output, amperage). Each of these topics will be briefly discussed on this page below.

Engineering Terms & Symbols

This NCEES topic is very vague and provides little information for the aspiring professional engineer. Engineers become more familiar with terms, symbols and technical drawings with experience, as they encounter new things. It is the opinion of the author that a test on your knowledge of random terms or symbols, other than those presented in the other topics is not fair nor is an adequate measure of a minimally competent professional engineer. The HVAC and Refrigeration field is a large field and it would not be prudent use of your time to memorize terms and symbols. However, you should know the terms and symbols presented in this book, since the exam will cover these topics and you should know the terms and symbols relevant to the topics covered in the exam.

Technical drawings are a single tool used by engineers to present ideas to others. An engineer should be able to produce technical drawings to accurately communicate ideas and the engineer should also be able to read and interpret technical drawings. Engineering drawings are not typical drawings, sketches or illustrations. These drawings show data like sizes, shapes, angles, tolerances, and dimensions. On the exam, you may be tested on your interpretation of these engineering technical drawings.

For the HVAC and Refrigeration PE exam, the drawings you will encounter will be schematics and diagrams that show cooling or heating processes. For example, a diagram could show a heat exchanger with the flow rates and entering temperatures of hot and cold fluids. The question could ask you for the exit temperature of the cold fluid given a certain LMTD. Basically, you do not need to specifically study engineering terms and symbols because you will encounter these terms and symbols throughout the technical study guide and within your references. Whenever you encounter a new term or symbol, be sure to take note of it in your notes.

Economic Analysis

As a professional engineer, you will be tasked with determining the course of action for a design. Often times this will entail choosing one alternative instead of several other design alternatives. Engineers need to be able to present engineering economic analysis to their clients in order to justify why a certain alternative is more financially sound than other alternatives. The following sub-sections will present the minimal engineering economic concepts that should be understood by the aspiring professional engineer and does not present a comprehensive look into the study of economics in the realm of engineering.

Money is worth more today than in the future. Interest rate and the time value of money.

Before discussing interest rate, it is important that the engineer understand that money today is worth more

than money in the future. This is an example of the time value of money. For example, if you were given the option

to have $1,000 today or to have $1,000, 10 years from now. Most people will choose $1,000 today, but not understand

why this option is worth more. The reason $1,000 today is worth more is because of what you could have done with that

money and in the financial world this means how much interest could you have earned with that money.

If you took the

$1,000 today and invested it at 4% per year, you would have $1,040 dollars at the end of the first year.

$1,000 x (1+.04)=$1,040

If you kept the $1,040 in the investment for another year, then you would have $1,081.60.

$1,040 x (1+.04)=$1,081.60

At the end of the 10 years the investment would have earned, $1,480.24.

$1,000 x (1+.04)x(1.04)x(1.04)……=$1,000 x (1.04)^10=$1,081.60

An important formula to remember is the Future Value (FV) is equal to the Present Value (PV) multiplied by (1+interest rate), raised to the number of years.

PV x (1+i)^10=FV

As an example, what would be the present value of $1,000 10 years from now, if the interest rate is 4%.

PV x (1+.04)^10=$1,000

PV =$675.46

Thus in the previous example, receiving $1,000, 10 years from now, is only worth $675.46 today. It is important to understand present value because when analyzing alternatives, cash values will be present at all different times and the best way to make a uniform analysis is to first convert all values to consistent terms, like present value.

Convert all terms to consistent terms.

For example, if you were asked if you would like $1,000 today or $1,500 in 10 years (interest rate at 4%), then it would be a much more difficult question. But with an understanding of present value, the "correct" answer would be to accept $1,500, 10 years from now, because you would only be able to get $1,480 10 years from now, should you accept the $1,000 today, with the current interest rate of 4%. In this example, the $1,000 today was converted to the future value 10 years from now. Once this value was converted, it was then compared to the future value that was given as $1,500, 10 years later.

Annual Value

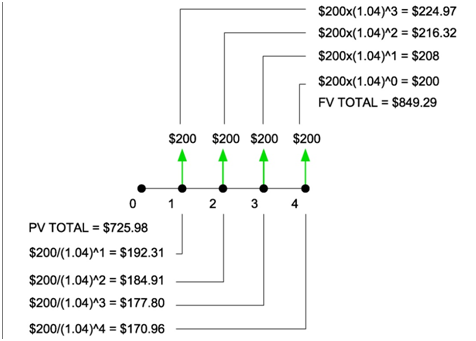

The previous section described the difference between present value and future value. It also showed how a lump sum given at certain times are worth different amounts in present terms, basically the value of a lump sum now is not worth the same in the future. In engineering, there are often times when annual sums are given in lieu of one time lump sums. An example would be annual energy savings due to the implementation of a more efficient HVAC system. Thus, It is important for the engineer to be able to determine the present/future value of future annual gains or losses. For example, let's assume that a solar hot water project, provides an annual savings of $200. Using the equations from the previous section, each annual savings can be converted to either present or future value. Then these values can be summed up to determine the future and present value of annual savings of $200 for four years at an interest rate of 4%.

For longer terms, this method could become tedious. Luckily there is a formula that can be used to speed

up the process in converting annuities (A) to present value and future value.

FV=A*(((1+i)^n-1)/i)

FV=200*(((1+.04)^4-1)/(.04))=$849.29

PV=A*((1-(1+i)^(-n))/i)

PV=200*((1-(1+.04)^(-4))/(.04))=$725.98

Reverse Equations:

A=PV*((i*(1+i)^n)/((1+i)^n-1))

A=FV(i/((1+i)^n-1))

Equipment Type Questions

In the HVAC and Refrigeration field, often times the engineer must develop an economic analysis on purchasing one piece of equipment over another. In this event the engineer will use terms like present value, annualized cost, future value, initial cost and other terms like salvage value, equipment lifetime and rate of return.

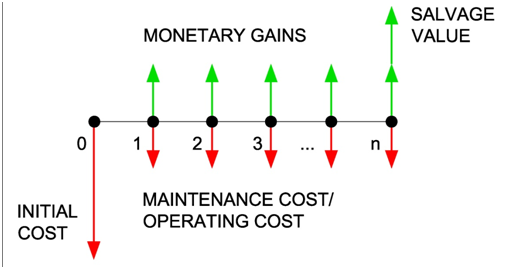

Salvage value is the amount a piece of equipment will be worth at the end of its lifetime. Lifetime is typically given by a manufacturer as the average lifespan (years) of a piece of equipment. Looking at the figure below, initial cost is shown as a downward arrow at year 0. Annual gains are shown as the upward arrow and maintenance costs and other costs to run the piece of equipment are shown as downward arrows starting at year 1 and proceeding to the end of the lifetime. Finally, at the end of the lifetime there is an upward arrow indicating the salvage value.

As previously stated, the most important thing in engineering economic analysis is to convert all monetary gains and costs to like terms, whether it be present value, future value, annual value or rate of return. Each specific conversion will be discussed in the following sections. Each of the sections will use the same example, in order to illustrate the difference in converting between each of the different terms.

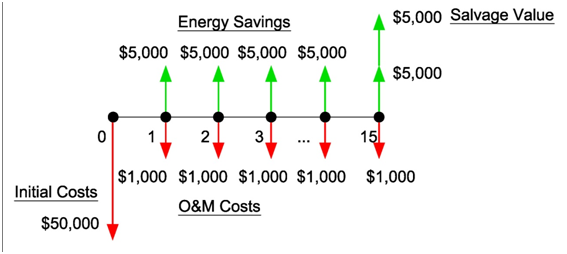

Example:

A new chiller has an initial cost of $50,000 and an yearly maintenance cost of $1,000. At the end of its 15 year lifetime, the chiller will have a salvage value of $5,000. It is estimated that by installing this new chiller, there will be an energy savings of $5,000 per year. The interest rate is 4%.

Convert to Present Value

What is the Present Value (Present Worth) of this chiller?

The first term, initial cost is already in present value.

PV_(initial cost)=-$50,000

The second term, maintenance cost must be converted from an annual cost to present value.

However, we can add the annual energy savings to this amount to save time.

A_(OandM cost) +A_(energy savings)=-$1,000+$5,000=$4,000

PV_(OandM+energy savings)=$4,000*((1-(1+.04)^(-15))/(.04))=$44,473.55

The third term, salvage value must be converted from future value to present value.

PV_(salvage value)=$5,000/((1+.04)^15 )= $2,776.32

Finally, summing up all the like terms.

PV_total= PV_(initial cost)+PV_(OandM+energy savings)+PV_(salvage value)

PV_total=-$50,000+$44,473.55+$2,776.32=$-2750.13

A negative Present Value indicates that the investment does not recoup the initial investment.

Convert to Future Value

What is the Future Value (Future Worth) of this chiller at the end of its lifetime?

The first term, initial cost is in present value and must be converted to future value.

FV_(initial cost)=-$50,000*(1+.04)^15=$-90,047.18

The second term, maintenance cost must be converted from an annual cost to future value. However, we can add

the annual energy savings to this amount to save time.

A_(OandM cost) +A_(energy savings)=-$1,000+$5,000=$4,000

FV_(OandM+energy savings)=$4,000*(((1+.04)^15-1)/(.04))=$80,094.35

The third term, salvage value is already in future value.

FV_(salvage value)=$5,000

Finally, summing up all the like terms.

FV_total= FV_(salvage value)+FV_(initial cost)+FV_(OandM+energy savings)

FV_total=$80,094.35-$90,047.18+$5,000=$-4,952.83

Convert to Annualized Value

What is the Annual Value of this chiller?

The first term, initial cost is in present value and must be converted to annual value.

AV_(initial cost)=-$50,000*((.04*(1+.04)^15)/((1+.04)^15-1))=$-4,497.06

The second term, maintenance cost is already annualize. However, we can add the annual energy savings to this amount to save time.

AV_(OandM cost) +AV_(energy savings)=-$1,000+$5,000=$4,000

The third term, salvage value is in future value and must be annualized.

AV_(salvage value)=$5,000((.04)/((1+.04)^15-1))=$249.71

Finally, summing up all the like terms.

AV_total= AV_(salvage value)+AV_(initial cost)+AV_(OandM+energy savings)

AV_total=$249.71-$4,497.06+$4,000=$-247.35

Convert to Rate of Return

What is the rate of return on the investment of $50,000 for the new chiller? The rate of return is a tool used by engineers to describe how profitable or un-profitable an investment is over an equipment's lifetime. The calculation involves determining for a $ investment and a $ monetary gain or loss, what would be the equivalent interest rate. In the previous example, $50,000 is invested in a new chiller and the returns on this chiller are $4,000 a year ($5,000 energy savings minus $1,000 OandM) and a salvage value of $5,000 at the end of the 15 years. For the calculation of rate of return (ROR) or return on investment (ROI), the salvage value is assumed to be $0 only to simplify the problem. The ROR is calculated as what "i" value is required in the below equation to make both sides equal. This approach takes trial and error, unless you have a computer or financial calculator.

$4,000*((1-(1+i)^(-15))/i)=$50,000

First try, i= .04 (4%).

$44,473.55 is less than $50,000

Second try, i= .03 (3%).

$47,751.74 is less than $50,000

Third try, i= .025 (2.5%).

$49,525 is less than $50,000

Fourth try, i= .023 (2.3%).

$50,262 is greater than $50,000

Correct answer is approximately, 2.4% ROR. Since, the ROR is less than the interest rate of 4%, this investment is not wise.

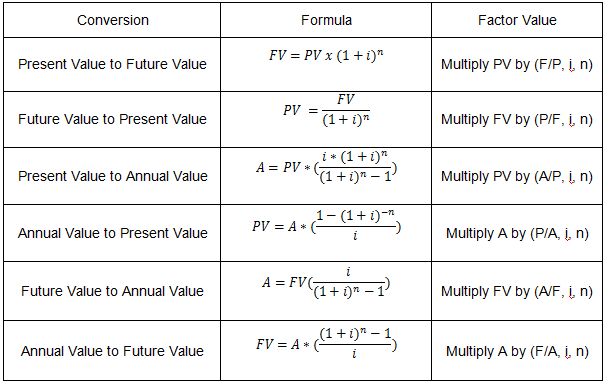

Use your factor tables in the MERM during the Mechanical PE Exam

When conducting engineering economic analyses, factor values are used in lieu of formulas. Factor values are pre-calculated values that correspond to (1) a specific equation (convert present value to annual, convert present value to future, etc.), (2) an interest rate and (3) number of years. Looking up these values in a table is sometimes quicker than using the equations and lessens the possibility of calculator error. It is recommended that the engineer have the Mechanical Engineering Reference Manual (MERM) which has tables of these factor values. A summary of the factory values are shown below.

Electrical Concepts

The final topic under Basic Engineering Practice is Electrical Concepts. This topic covers motor ratings, heat output, amperage and power consumption. In this topic you will need to be able to find out the heat output from pump and fan motors and be able to determine the demand power (kW) and energy consumption (kwh). You should be familiar with terms like power factor, three phase vs one phase power, amperage, voltage and demand vs. usage.